Financial Planning Issues and Australian Expatriates

Much of the criticism often leveled at financial planning in Australia relates to the fact that Financial Plans are often “push button” in nature, driven by standard templates and producing generic recommendations. This has potentially serious implications for clients and particularly for expats, whose circumstances often exist well outside the Australian financial planning “mainstream”.

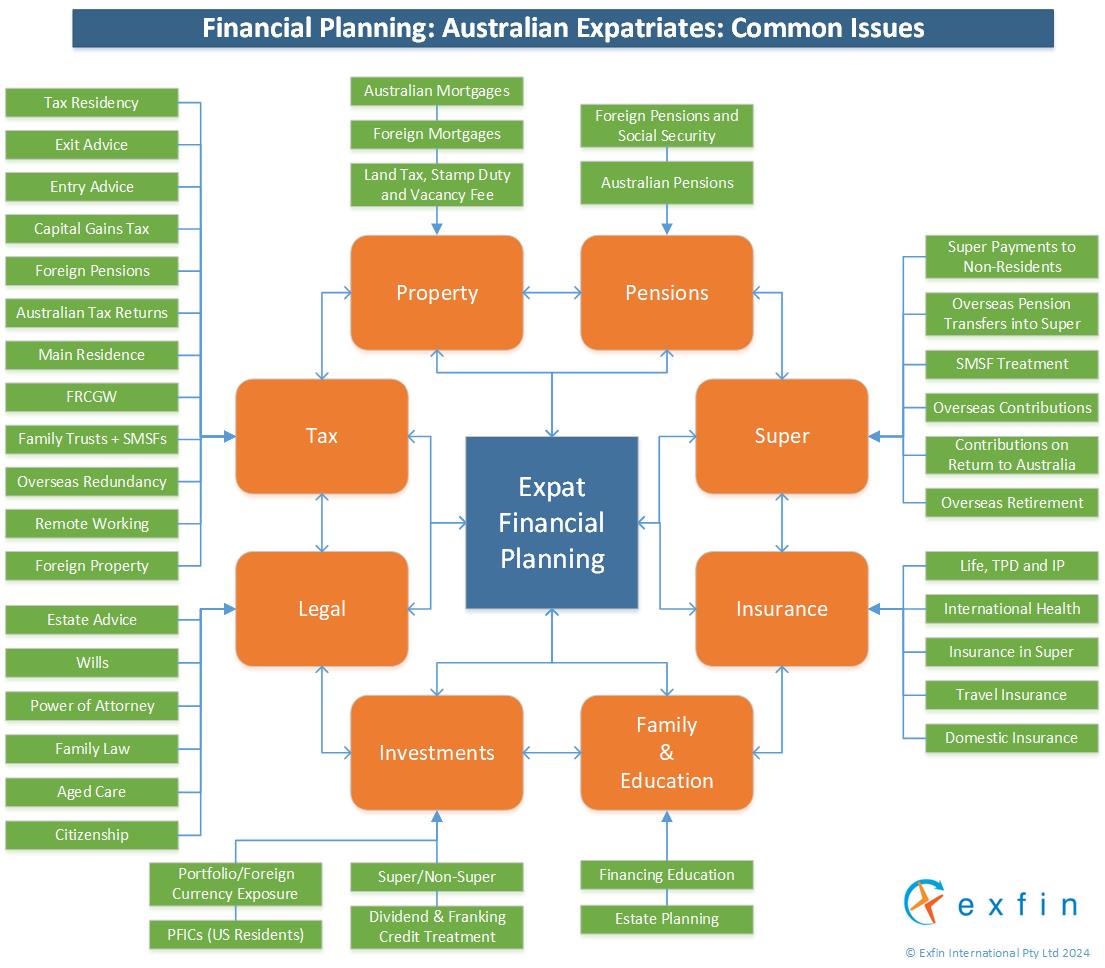

We routinely, on day to day basis, deal with an extremely wide range of issues. The flow chart below provides an introduction to some of the more common matters arising, and we also provided some general supporting commentary below.

Taxation

As we mention elsewhere, financial plans will always consider the tax implications of any strategy. Depending on individual circumstances, expatriation will often make taxation a much more complicated consideration because multiple jurisdictions may be involved, and expats should only seek advice from a professional tax advisors who are familiar and experienced with offshore issues, including advice around Double Taxation treaties, where applicable.

The issue of tax residency will often be key, and expatriates should also be aware of the advantages of using the Australian tax system to build assets in Australia that can be potentially free from capital gains tax; and be familiar with how any Australian assets will be treated for both income and capital gains tax purposes.

Assessing Additional Benefits and Costs

In a traditional expatriate environment, the employer would often provide a range of services within the expat package - including education assistance for the children, health care, accommodation and annual return travel to the base country. While this still occurs, other employers are increasingly offering local packages or “cash in lieu” of providing benefits.

It should be appreciated that, while a package might appear very attractive when viewed from Australia, the cost of the benefits mentioned above - and particularly education (both host country and base country boarding) and housing can be very, very significant. Consequently, issues such as meeting education and healthcare costs, need to be considered well in advance of accepting any assignment.

Life Insurance

Part of any financial plan should include a review of how well protected a family's assets and income are in the event of an untimely death, injury or critical illness. While employers in the host country may provide some coverage, expats should appreciate that i) any additional insurance cover, if necessary, may be difficult to obtain back in Australia - depending on the type of insurance, your particular host country and when you intend to return to Australia, and ii) there is some possibility that an expat may be voiding their existing life insurance cover back in Australia as a consequence of becoming non-resident for a long period. These factors strongly support a review of life insurance adequacy before an expat leaves Australia.

Superannuation and Retirement

The financial planner should consider your particular position in relation to superannuation when considering an overseas assignment. For example, whether you should continue to make superannuation contributions in Australia, opt out entirely in favour of an international retirement structure which is more tax favourable for the period of your non-residency, or “make up” contributions to an offshore structure.

Much will depend upon your current superannuation arrangements in Australia, any plans you have in terms of where and when you plan to retire, and regulations within your host country regarding superannuation/pension contributions and transfers. If you are in a Self Managed Superannuation Scheme (SMSF) in Australia, you need to be extremely careful that your residency outside of Australia does not affect the residency of the fund and hence make it non-complying and subject to substantially higher tax rates.

Expats will often accrue pension funds overseas during their career and particular care needs to be taken when considering any pension transfer to Australia, to ensure it happens in a tax effective fashion. In that regard, it is important that expats pursue specific advice before again becoming resident for Australian tax purposes. Pension funds vary enormously, and our experience over time has included the treatment of funds from a variety of countries, including the US (401(k)s, 403(b)s, IRAs, Roth IRAs and occupational schemes), the UK (personal pensions, SIPPs and occupational schemes), Canada (RRSPs, LIRAs and occupational schemes), Singapore, Hong Kong, Ireland and South Africa.

The fact that non-concessional superannuation contributions have recently been reduced significantly strengthens the need to plan for superannuation and retirement well in advance of any physical return to, or arrival in, Australia.

If you would like to arrange professional advice please complete the Inquiry form below providing details and you will be contacted promptly.