Australian Expats and Financial Planning

An Introduction

We have been privileged to provide access to specialist professional advice to Australian expats and migrants to Australia since 2004, through vastly differing circumstances - ranging from the GFC to the resources boom and, more recently, during Covid 19 and the ensuing acceleration in international remote working.

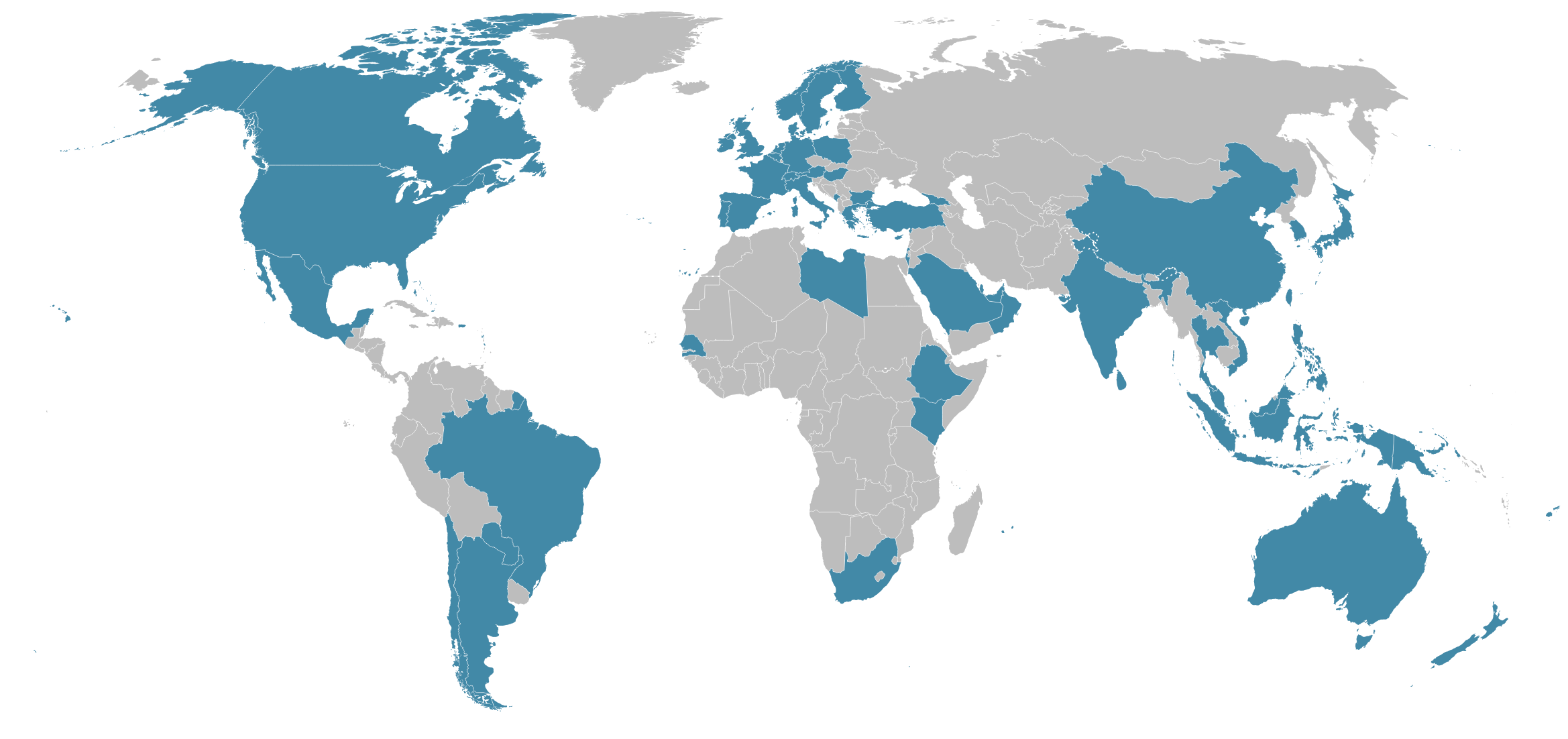

To provide some indication of the breadth of advice provided, inquiries to the website and client advice over just the last three years have spanned more than 90 countries worldwide and, apart from providing advice to Australian expats, has involved the provision of services to more than 50 different nationalities. The map below shows the countries from which we received inquiries in 2024.

For expats, the true value of financial planning is to place a consistent strategic framework around all your financial activities and decisions. This focus is particularly important for Australian expats and migrants to Australia for a number of important reasons, including the following issues.

Effective Tax Planning in Australia and Overseas

Expats will usually have relationships with at least two tax regimes and two currencies - significantly increasing the complexity of their affairs. For example, the fact that you are tax non-resident also does not necessarily preclude you from liability for Australian capital gains tax, or for submitting an Australian tax return if, for example, you have an income producing property. Yet, you may still be liable for both income and capital gains tax in your current host country. Additionally, while Australia does not have an inheritance or estate tax, different capital gains tax (CGT) rules can apply to non-resident Australians and these should be considered as part of any estate planning. Additionally, the sale of Australian property can have very different, and negative, tax implications if made while non-resident.

A failure to actively manage your tax position both in Australia and your host country, whether because of the apparent complexity or otherwise, will often represent a costly "lost opportunity". We would particularly encourage you to read through the expat tax materials on Exfin to familiarise yourself with the broad issues that can arise on embarkation, during your time as a non-resident and on return to Australia.

Investment Planning

Depending on your circumstances, your time as an expat can represent your best opportunity to amass real wealth by virtue of a higher income and a reduced tax base. Sensible and strategic financial planning can ensure that you both enjoy the experience of being an expat and take full financial advantage of your time overseas. Also, some investment instruments commonly sold overseas to expats are not necessarily suitable for Australian expats for tax reasons and care needs to be taken in choosing investments structures such as offshore trusts and companies.

Additionally, expatriation almost always gives rise to issues with respect to currency management, including ensuring that you are not over-exposed to particular currencies and that your exposure is consistent with future plans. For example, if there is a clear desire to return to Australian in retirement but a major portion of an your assets are in foreign pension funds, then investment planning and selection can often provide an indirect hedge against adverse AUD currency movements ahead of any return to Australia. Planning and tax advice is typically also crucial if overseas pension funds are to be effectively returned to Australia, into superannuation, cash or other investments.

Additional Expatriation Costs

Initially, new expats will probably experience some dislocation, and this can extend to finances and mean that you will not make the best use of income flows. Conversely, there are also some areas where there can be substantial, long-term increases in costs, such as with education and health, which need to be reflected in your financial arrangements; particularly in terms of life insurance and investments.

Retirement Planning

Whilst overseas you will invariably be faced with making decision about what investments you should make and whether they should be offshore or in Australia; the optimal answer will probably depend very much on your personal circumstances, such as your age, the time until you again become an Australian resident and your current host country tax environment. Relatively recent changes to Australian superannuation, reducing the level of non-concessional contributions, means that many Australian expats need to consider long-term planning to ensure they make full use of their superannuation entitlements.

On the other hand, it may be very tax effective to make contributions into local pension schemes and then transfer those schemes into Australian superannuation – if the transfer arrangements are clear, the exit costs low and those pension funds meet certain Australian tax requirements. In many cases, however, there are significant complexities attaching to the transfer of overseas pensions into Australia - and the costs of "getting it wrong" can be very substantial.

Repatriation Planning

There are quite a few issues which can arise on return to Australia which are significant from a financial viewpoint and deserve to be treated professionally; these include the repatriation of any pension funds as mentioned above and the (tax) treatment of any funds or investments which have been amassed offshore. Australian expats almost invariably return to Australia, rather than settle overseas, and this makes it important for them to properly structure their affairs with the Australian financial system in mind so that you do not miss out on opportunities and ensure that decisions are tax effective.

Why Exfin?

While most Australian financial planners are focused entirely on the domestic Australian market we have a longstanding network of planners who specialise in providing advice to expats and focus on specific areas of expat concern - integrating well with other specialists such as tax advisors, lawyers and actuaries, as required, to provide broad advice.

All planners welcome inquiries from expats and are happy to have an initial discussion with expats on a no-commitment basis, whether over the telephone, Zoom or in person, to discuss their individual situation and to see whether they can provide assistance in their area of concern.

Financial planners are expected to work on the basis of providing full disclosure to the client of all remuneration, and prospective clients will be provided with a fee quotation in advance for any services or advice being provided.

If you would like to arrange professional advice please complete the Inquiry form below providing details and you will be contacted promptly.