SMSF Members who become Expats - Tax Residency and Other Issues

Self Managed Superannuation Funds (SMSF's) are a very common feature of the Australian superannuation landscape - these are funds with six or less members for individuals who want additional flexibility over the investment of their retirement funds. They may also be cost effective once a certain levels of funds are involved – there is some argument over the precise amount, but $300,000 is probably a reasonable indication. Note that the members of the fund are required to be trustees of the fund or directors of a corporate trustee of the fund.

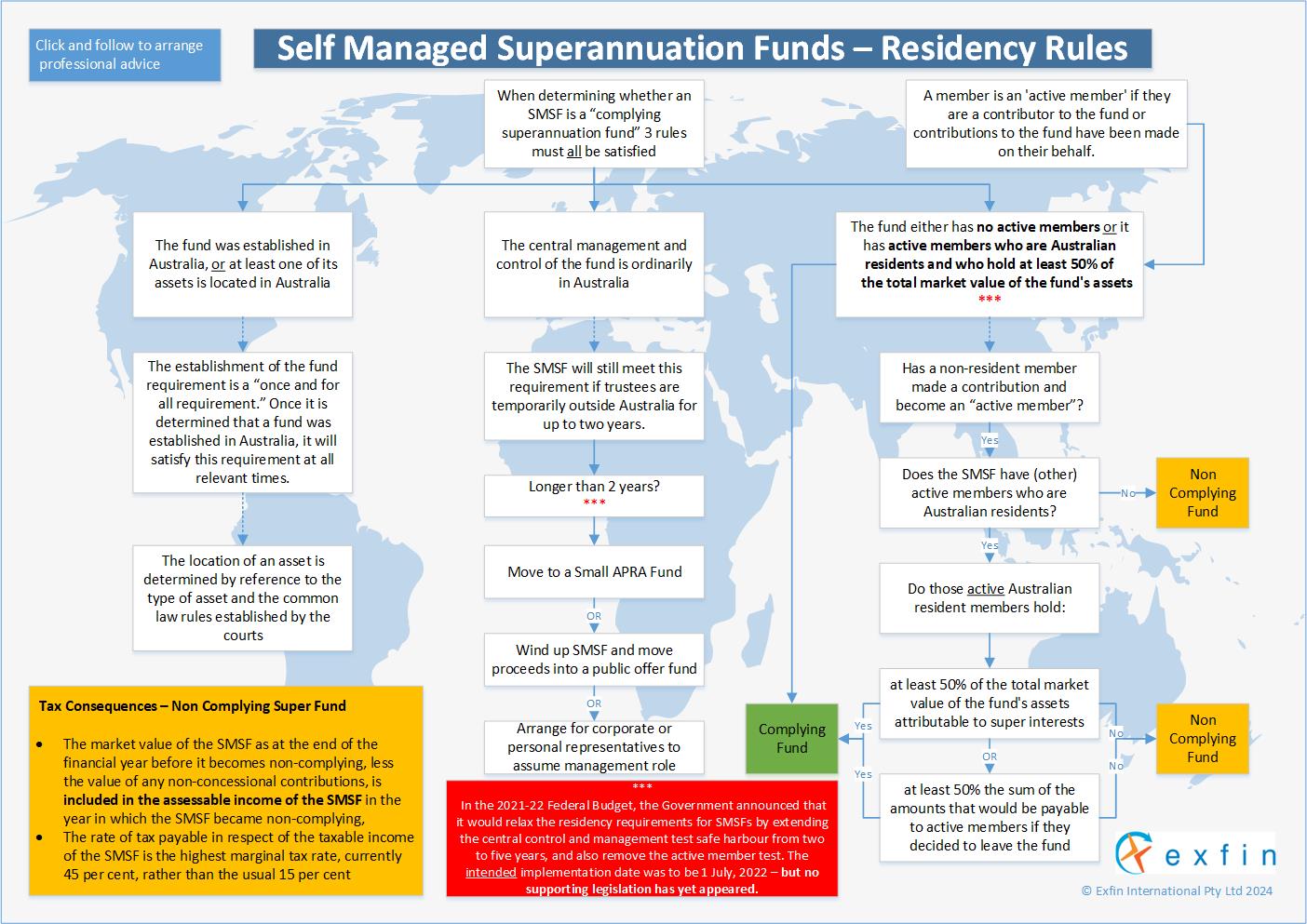

The income tax concessions available to superannuation funds are a direct function of the fund's ability to comply with prudential standards under Australian superannuation law – and this is also the case with SMSF’s. Non compliance with these standards can lead to heavy penalties, with both earnings and assets potentially taxed at a rate of 45% in the first year if a fund becomes non-resident for tax purposes. In this context, be aware that a trust's residency is usually determined by the trustee's residency.

The ATO regularly include the residency status of SMSF's in their compliance programs, and for a fund to be considered a complying fund which is eligible for tax concessions, it must remain a resident regulated superannuation fund for the entire tax year. In order to fulfill the residency requirements, the fund must:

- either have been established in Australia, or have any assets situated in Australia at the relevant time;

- have central management and control in Australia, or the fund trustees must satisfy the temporary absence rule;

- have at least one active member (an Australian resident who contributes to the fund or who has contributions made on their behalf), and

- the percentage of accumulated entitlements of resident active members is at least 50% of the total accumulated entitlements of all members. If a fund is without an active member, then only the first two requirements must be satisfied.

![]() In the 2021 Federal Budget the Government announced that it intended to relax the residency requirements for SMSFs by extending the "safe harbour" for the central management and control test from 2 to 5 years for SMSFs and removing the "active member" test for both fund types.

In the 2021 Federal Budget the Government announced that it intended to relax the residency requirements for SMSFs by extending the "safe harbour" for the central management and control test from 2 to 5 years for SMSFs and removing the "active member" test for both fund types.

The changes were intended to take effect from 1 July, 2022 but no legislation has yet been tabled in Parliament and there is no clarity regarding when or if changes will now be legislated.

The ATO have indicated elsewhere that they have little discretion available in enforcing these requirements, so it is absolutely essential that trustee/members of SMSF funds seek professional advice prior to moving overseas unless it is for a relatively short period of time.

One approach to addressing this issue is to delegate "central management and control of your fund" via a power of attorney to a person(s) who remains in Australia, or corporate trustee - others include dissolving the fund and rolling it over to a public offer or retail fund, or setting up a small APRA fund. Additionally, absolutely no payments should be made into an SMSF by a non-resident member without prior advice.

You must seek professional advice in this regard - the cost of not addressing this issue, or being nonchalant about how your SMSF is managed or structured could, as mentioned above, be very substantial. We have also provided a flow chart below which further outlines residency requirements and those situations where a superannuation fund may be non-compliant; but there is no substitute for specific professional advice in any circumstance where the residency of a superannuation fund is involved.

Further information regarding tax residency issues as they apply to SMSF's can be found in the tax ruling, TR 2008/9.

If you would like to arrange professional advice please complete the Inquiry form below providing details and you will be contacted promptly.