Superannuation for Foreign Residents - Making Contributions and Receiving Payments while Overseas

Contributions to Superannuation

Non-residents can continue to make superannuation contributions to superannuation funds in Australia; the rules regarding eligibility to make these contributions in Australia apply equally to residents and non-residents. You should not, however, make contributions whilst non-resident to a self managed superannuation fund without prior professional advice.

Generally, it is viable and appropriate to make further contributions to Australian super if your objective is to eventually retire in Australia, or if the taxation on Australian superannuation is more attractive than the country of residence. This is where taxing rights and double tax treaty arrangements can have a major impact.

For example, as long as withholding taxes, or other costs, are not significant it may be better to make tax effective contributions into your local pension fund which you later withdraw and transfer to Australia, rather than continuing super contributions - and sometimes you will have little or no choice in this regard. There are forex risks associated with this approach and you also need to be mindful of the limits on non-concessional contributions into superannuation in terms of any eventual withdrawal/transfer to Australia.

Note, however, that some superannuation funds will require that members are residents, therefore you may need to rollover your super into a fund that accepts non-residents - ideally before you leave the country. If you have been transferred overseas by your employer then it is likely the fund will make provision for non-residents, with your employer continuing to make contributions - probably on the basis of your Australian “pensionable base salary”, or equivalent.

In these situations, if you are in receipt of additional salary reflecting expatriate conditions, an issue may be whether it is appropriate for you to make additional retirement contributions and whether it should be into your Australian fund. Expats may be better served making contributions into an International retirement fund, or some other investment structure rather than simply continuing with their current, Australian arrangements. There is additional discussion of the International options available but you should ultimately seek professional advice in this area.

Is your Employer obliged to pay superannuation whilst you are overseas?

At the present time, Australian employers are required to make a superannuation guarantee (SG) payment into an Australian superannuation fund representing 11% of ordinary times earnings from 1 July, 2023. This contribution will increase increase gradually to 12% over the period to 2025/26. There is however an exemption from this requirement for employees working outside Australia, if:

• The employee has become non-resident of Australia for tax purposes; or

• The employing entity (company, partnership, individual etc.,) is a non-resident of Australia for tax purposes.

However, if the employee remains a resident of Australia for income tax purposes, and an Australian employing entity continues to employ them, then the employer is required to continue to make contributions.

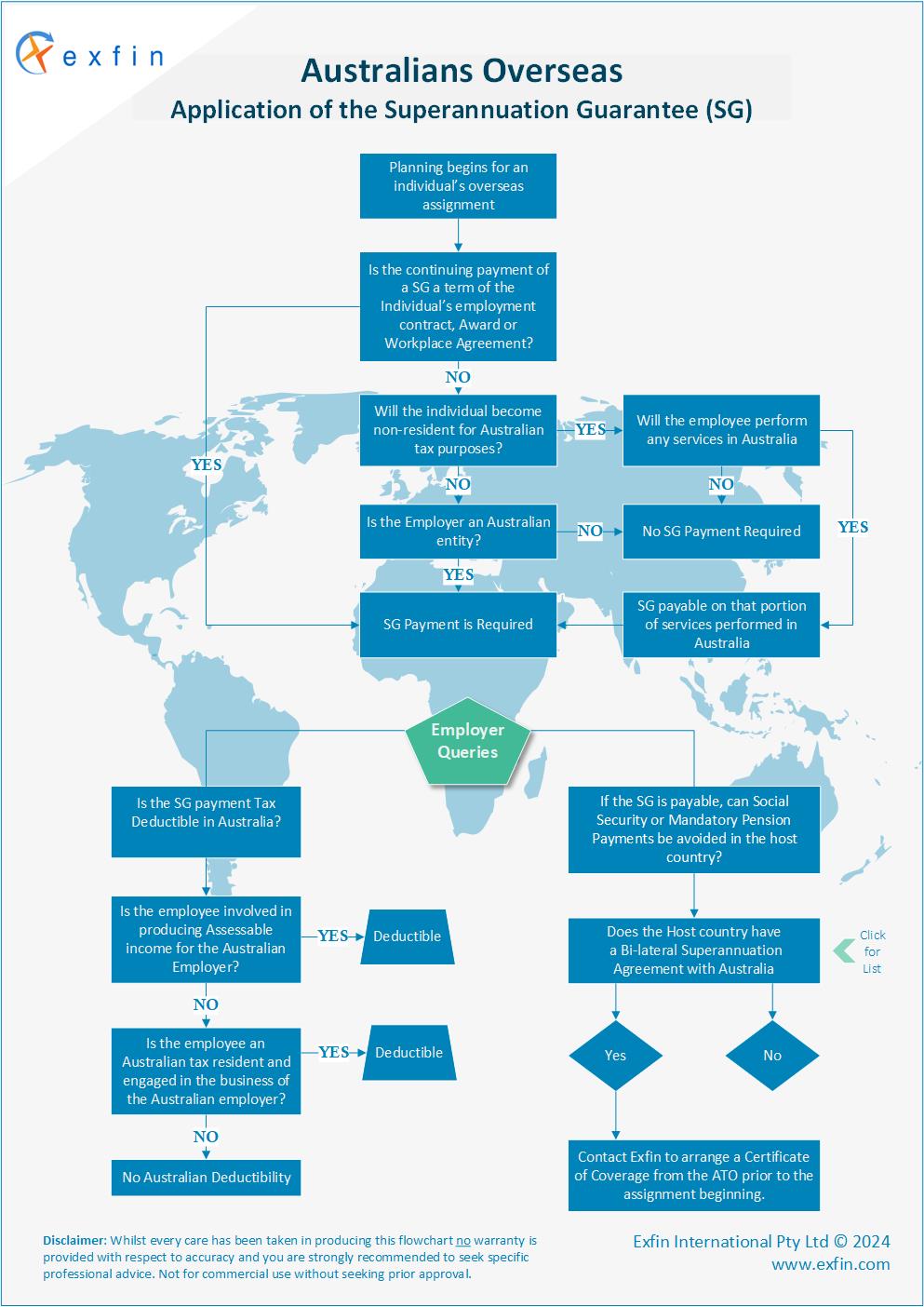

In addition, contributions may continue to be required as a consequence of Industrial awards, Enterprise Agreements, Australian Workplace Agreements; or individual employment contracts. To assist both employees and employers assess whether they have a continuing SG entitlement and/or whether social security payments need to be made in the host country - as well as whether payments made overseas are deductible in Australia - we have created a flow chart available for download below.

Note that employers may also be able to apply for Certificates of Coverage, so that social security payments don't also need to be made in the host country, so that there is no doubling up of social security costs. Employers should consult a tax advisor in this regard, before an assignment commences.

Australians employed outside of Australia on a fly in - fly out (FIFO) basis, who remain Australian tax residents, should be aware that if they are under the age of 65, or between age 65 to 74 and can meet a work test - they will be able to claim a tax deduction for personal contributions to eligible superannuation funds up to the concessional contributions cap. This should enable many Australians working overseas for employers who do not make pension fund contributions to make them personally on a tax effective basis.

Receiving Super Payments

Both lump sums and income stream payments made from a taxed superannuation fund are tax free to Australian tax residents aged over 60 - while payments made to individuals below age 60, or from untaxed funds (largely public service funds), may attract tax in Australia depending on a number of factors.

If your intention is to retire overseas, or spend enough time in individual countries to become tax resident in another country, then it is extremely important that you arrange prior professional tax advice about how any superannuation income streams or lump sums will be taxed. How any payments will be treated from a tax perspective in foreign countries will depend upon a number of factors, including the existence or otherwise of a double tax agreement, and the mere fact that no tax is typically payable in Australia on super payments does not mean that tax will not be payable overseas.

Additionally, it is possible that non-resident rates of Australian tax may be levied on payments to members of untaxed (usually Government, public sector, funds) superannuation funds living overseas - and, if those individuals are living in a country with which Australia has no double tax agreement, then there is also the possibility of double tax applying.

Finally, remember that access to super is subject to minimum drawdown rates, which are age dependent - effectively increasing in tranches with age. From July 1, 2023 minimum annual super drawdown rates "returned to normal" after being halved as one part of the response to the Covid 19 pandemic. Note that these are minimum rates of withdrawal - members may withdraw more than these amounts.

Current Minimum Super Drawdown Rates (%)

| Age | Minimum Drawdown |

| Under 65 | 4% |

| 65 - 74 | 5% |

| 75 - 79 | 6% |

| 80 - 84 | 7% |

| 85 - 89 | 9% |

| 90 - 94 | 11% |

| 95 or over | 14% |

If you would like to arrange professional advice please complete the Inquiry form below providing details and you will be contacted promptly.