Types of Superannuation Contributions and Caps

Contributions made to an Australian superannuation fund can be characterised as either Concessional (pre-tax) or Non-Concessional (after-tax) in nature and both are subject to specific contribution limits or caps - usually of an annual nature, but sometimes multi-annual.

The tables below summarise these two types of contribution and the current applicable caps and some significant changes which took effect from July 1, 2017. The most significant change was the introduction of a cap of $1.6M on the amount of total funds which could be held in retirement income accounts (but not in accumulation accounts) and earn tax exempt income in retirement. This is referred to as the Transfer Balance Cap (TBC) and it increased to $1.7M on July 1, 2021, $1.9M on 1 July, 2023 and $2M on 1 July, 2025.

We recommend that you seek prior professional advice if you believe any changes may affect your position significantly - the Government again added significant additional complexity to superannuation and expatriates were particularly affected because the markedly reduced non-concessional cap levels effectively limited the ability to transfer offshore pensions into superannuation. Better, longer term planning is now an absolute requirement - particularly for long term expats returning to Australia with substantial overseas pension balances.

1. Concessional Contributions - In Summary

Otherwise known as Pre-Tax or Non-Deductible Contributions - they include:

- Superannuation Guarantee contributions

- Additional employer contributions

- Salary sacrifice contributions and

- Contributions made by the self-employed if they meet deductibility rules, and

- Additional personal contributions

Annual Concessional Caps

| 1 July 2017 to 30 June 2021 | From 1 July 2021 | From 1 July 2024 | |

| Up to and including Age 66 | $25,000 | $27,500 | $30,000 |

| Age 67 - 74 | $25,000 subject to meeting "work test" | $27,500 with no "work test" applicable unless claiming a tax deduction for contributions | $30,000 with no "work test" applicable unless claiming a tax deduction for contributions |

Catch Up Payments from July 1, 2018

If you have less than $500,000 in your super account, you can make catch-up payments if you haven’t reached your concessional contribution cap limit over a rolling five year period. These can be particularly important to expatriates returning to Australia as they provide more contribution capacity.

Spouse Concessional Contributions

From July 1, 2017, it has been possible to make contributions to your spouse or partner’s super and currently, if they earn up to $40,000 a year and are aged under 70, receive a low income spouse offset of up to $540 a year. From 1 July 2020 the spouse must be under 75 years old when the contributions were made.

Personal Super Contributions

With effect from 1 July 2017, anyone under 75 has been able to claim a tax deduction for personal payments they make to super up to the annual concessional cap - but be careful to consider contributions from all sources and ensure the cap is not breached.

Tax Treatment

Concessional contributions (CC) are typically subject to a tax of 15%, unless your adjusted annual taxable income is greater than $250,000; whereafter they are subject to an additional tax of 15%, referred to as a Division 293 tax, adding up to an effective tax rate of 30%.

Total concessional contributions from all sources above (including employer and personal contributions) cannot exceed the total CC annual cap - if they do then the additional contributions are taxed at your actual marginal tax rate, plus an interest charge.

2. Non-Concessional Contributions - In Summary

Otherwise known as Post-Tax, After-Tax or Undeducted Contributions

These include all contributions made from sources which have already been taxed, and this includes foreign pension transfers - except that part of the pension capital value which reflects growth since the date of residency - and Government co-contributions.

Annual Non Concessional Caps

| 1 July 2017 to 30 June 2021 | From 1 July 2021 | From 1 July 2024 | |

| Annual | $100,000 | $110,000 | $120,000 |

| Bring Forward Basis (3 Years) - if available | $300,000 | $330,000 | $360,000 |

Tax Treatment

If your total super balance is currently over the TBC you aren't be able to make any further non-concessional contributions to your super. The TBC is indexed periodically in $100,000 increments in line with CPI - in a "step fashion" that effectively lags inflation - it last increased from $1.9M to $2M from 1 July, 2025.

BackgroundEffective from July 1, 2017 you were not able to have more than $1.6 million in your retirement income account - and this has subsequently increased to $1.9M - with any excess needing to be withdrawn as a lump sum (if possible) or transferred into a super accumulation account where you will pay 15% tax on earnings within the fund. Note that the account can then organically grow to a balance of more than this amount through investments. In the May 2017 Federal Budget the Government announced that individuals and couples aged over 65 would each be able to contribute $300,000 from the sale of any main residence in which they have resided for 10 years or more into superannuation. This contribution does not count in terms of the annual non-concessional cap but is still subject to the current $1.9 million transfer balance cap. Note that the minimum age to access the "downsizing contribution" was reduced to 60 with effect from 1 July 2022, and reduced again to age 55 from 1 January 2023. This benefit is not typically available to expatriates/non-residents. |

Expatriates planning on making substantial contributions to their superannuation in the next few years, perhaps following or ideally in advance of a return to Australia, should discuss their position in detail with a financial planner. There can be a significant level of complexity associated with ensuring that superannuation balances are optimised within tax parameters and this is apart from advice with respect to the appropriate superannuation fund structure and investment profile.

Access to Superannuation Benefits

Superannuation benefits fall into three categories:

- Preserved benefits; this category now includes the vast majority of superannuation balances (all contributions post July, 1999)

- Restricted non-preserved benefits; although not preserved, these funds cannot be accessed until an employee meets a condition of release, such as terminating their employment in an employer superannuation scheme.

- Unrestricted non-preserved benefits; these do not require the fulfillment of a condition of release, and may be accessed upon the request of the employee.

You can only (generally) access your preserved superannuation funds:

- when you turn 65 (even if you haven’t retired), or

- when you reach preservation age and retire, or

- when you reach preservation age and access a Transition to Retirement (TRIP) pension, while continuing to work.

The Preservation Ages are:

| Date of Birth |

Preservation Age

|

| Before 1 July 1960 |

55

|

| 1 July 1960 - 30 June 1961 |

56

|

| 1 July 1961 - 30 June 1962 |

57

|

| 1 July 1962 - 30 June 1963 |

58

|

| 1 July 1963 - 30 June 1964 |

59

|

| 1 July 1964 and after |

60

|

Superannuation is Complex...

The superannuation system, even from a purely domestic perspective, is overly complex - and unless your situation is relatively simple you cannot be expected to have a full appreciation of how superannuation works and your available options. Consequently, particularly for expats, we strongly recommend that you consider seeking experienced financial planning advice earlier rather than later.

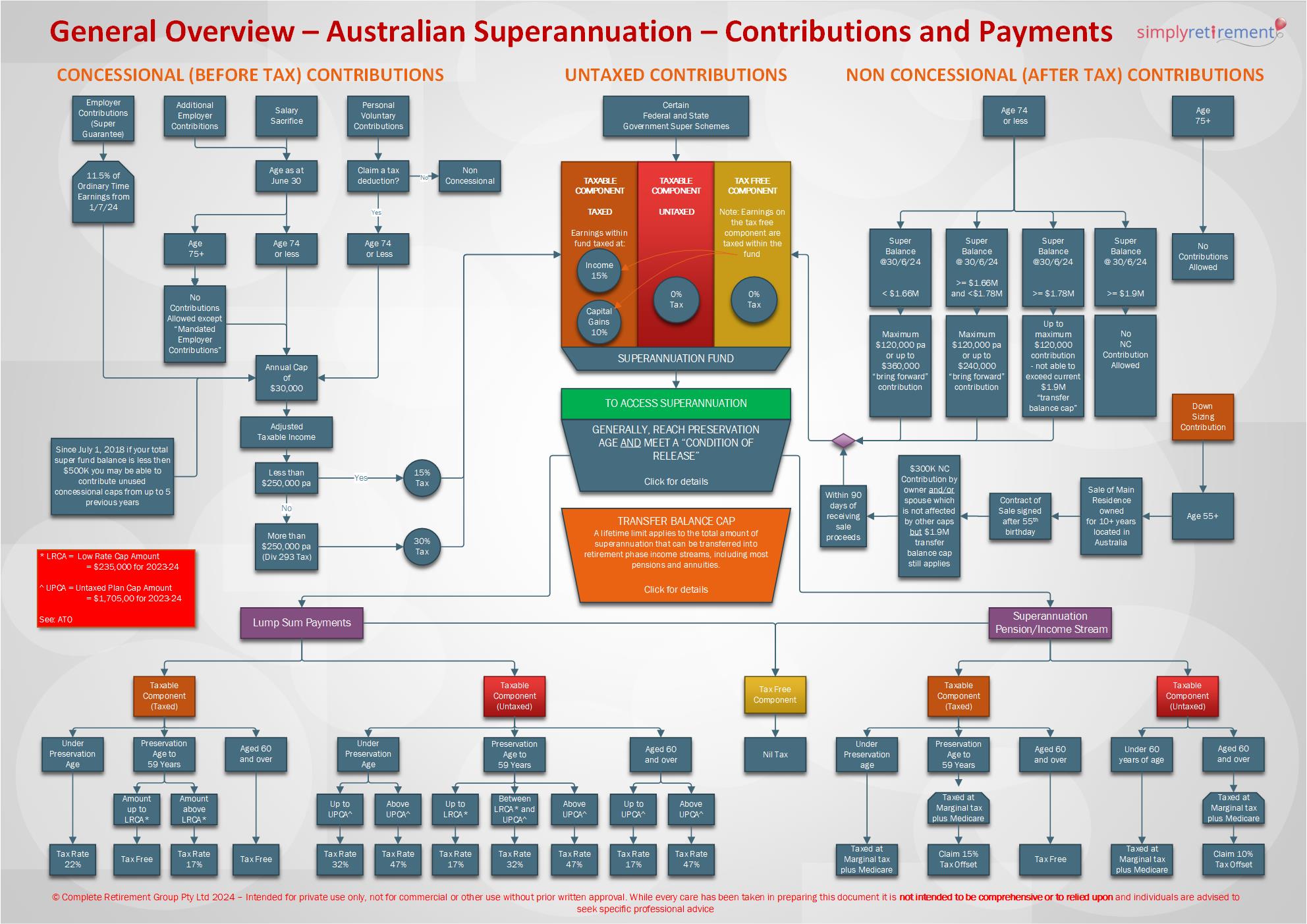

The relative complexity of superannuation is illustrated by the schematic or "simplified" flow chart of superannuation appearing below, and this is not a complete overview. It doesn't for example cover co-contributions or departing Australia superannuation payments (DASP) available to some temporary residents. It is not intended as an alternative to discussions with your financial advisor or superannuation fund but to help in putting the whole, complicated system in perspective.

If you would like to arrange professional advice please complete the Inquiry form below providing details and you will be contacted promptly.